Peak oil is a theory concerning the natural limits on the global population and civilization growth imposed by a finite availability of oil. This theory was first proposed by American geophysicist Marion King Hubbert in a paper presented in 1956 to the American Petroleum Institute.

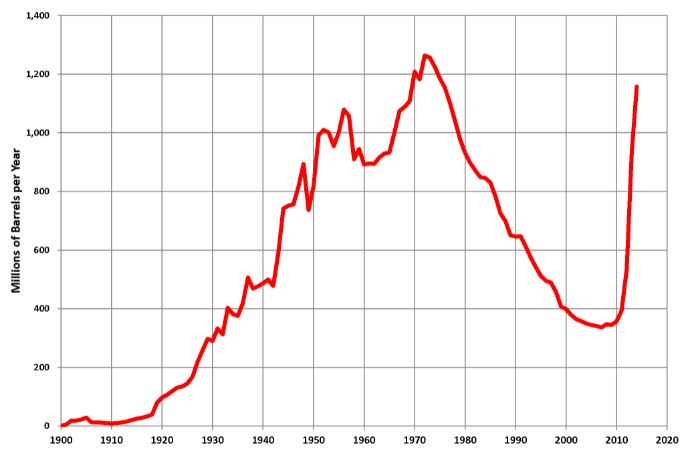

The concept of ‘Hubbert’s Peak’ explains that the discovery of new oilfields and the production capacity of existing fields would inevitably decline in the future. Dr. Hubbert predicted that American oil production would reach a peak and decline around 1965-1970.

This actually occurred in 1971. Dr. Hubbert also predicted that global oil production would peak and start declining around the year 2000.

There is debate amongst energy experts whether this milestone has passed, although currently accepted US Government projections show a marked decline in oil production by major oil-producing nations beginning in 2004.

Experts predicted in the 1970s that any peak and then subsequent decline in oil production globally would be immediately followed by a sharp increase in oil and gas prices.

Some point to the recent sharp rise in oil prices, which have risen more than 100% since January 2004, as an indication that this global peak has occurred.

However, there is active debate amongst energy experts as to whether the current increase in fossil fuel prices has resulted from declining supplies or is a result of current political instability in major oil-producing regions such as the Middle East.

Whatever the cause of the current price rises, most experts agree that a period of declining energy supply is looming on the near horizon.

The implications of Hubbert’s Peak on the US economy are profound. The prosperity and high growth rates that the United States has enjoyed since the end of World War II has been fueled in large part by the abundance of cheap energy provided by inexpensive oil supplies.

Much of the strength of the dollar domestically and abroad is tied to the trade of oil on the global market using the dollar as the basic currency. Additionally, the dominance of the US economy globally is threatened by rising oil prices, as a large percentage of the production capacity that drives the US Gross Domestic Product relies on abundant and cheap oil.

Any significant rise in energy prices in the United States will inevitably drive down the profits of American companies, and in turn, will depress the US economy.

As a result of recent declines in the dollar’s buying power versus other currencies like the Euro and the Chinese yuan, many oil-producing countries have floated the idea of decoupling global oil trade from the dollar in favor of a more stable currency.

Iran, for example, planned to open an oil bourse in their country in March of 2006, selling oil in Euros. This new oil market has not yet opened as of June 2006, but could do so anytime.

If it becomes common practice for countries to trade for oil in a currency other than the dollar, the damage to the US economy could be staggering. Currently, it is estimated that China alone holds 600 billion in reserve, in part to allow them to purchase oil on the world markets.

This trade-in oil allows the United States to run large budget deficits as other countries are required to purchase dollars on the currency markets in order to use them for their own oil purchases.

If these countries suddenly had to switch their currency purchases to Euros, for example, a flood of dollars would be released on world currency exchanges, further devaluing the dollar and severely increasing current US trade deficits with other nations.

Besides the direct impact on the dollar, the Peak Oil scenario has other implications for the US economy. Perhaps more than any other nation, the United States has built its infrastructure and its society on the promise of cheap energy.

People have moved en masse into suburban areas once utilized solely for agriculture and then depend on cheap gas to make their daily two-hour commutes. Large manufacturing companies build their facilities well away from large cities and then depend on trucks and highways to deliver their goods to their customers.

When gas prices rise, transportation costs increase significantly, driving up the cost of goods and services across the board. When individuals have to start paying double and triple for their commutes, communities suffer and people have to uproot themselves to be closer to their places of work and recreation.

The economy itself suffers because fewer goods are being sold, and those at a lower profit margin. This is a ripple effect that will leave none unscathed, except perhaps those who see the full implications of Peak Oil soon enough and change their own way of life.

Whether it is called ‘Peak Oil’ or ‘Hubbert’s Peak’ or any other name, it appears that the predictions made 30 years ago are coming to pass in the present time. The implications of rising energy prices on the US economy are sobering, but they are predictable.

It will take many profound changes in the United States to temper the effects of Peak Oil. These changes will have to be implemented with some haste in order for the direst effects to be countered, or society as a whole will suffer for it.