Your credit score is more than just a number—it’s a key to unlocking better financial opportunities. Whether you’re applying for a loan, mortgage, or credit card, a strong credit score can make all the difference. In this article, we’ll explore how achieving the right credit score can save you time, money, and frustration while helping you secure better approval rates and lower interest rates.

Building and maintaining a good credit score starts with understanding its importance in your everyday financial decisions. On-time payments and responsible credit management are foundational to improving your score. By prioritizing these habits, you can avoid costly delays and higher interest rates, making your financial goals more achievable.

Throughout this guide, we’ll provide actionable steps and strategies from trusted sources like Experian and Money to help you take control of your credit score. By the end of this article, you’ll have a clear roadmap to achieving and maintaining a healthy credit score that works in your favor.

Key Takeaways

- A good credit score can help you qualify for better loan terms and lower interest rates.

- On-time payments are crucial for building and maintaining a strong credit score.

- Responsible credit management can save you time, money, and frustration.

- Improving your credit score takes consistent effort and the right strategies.

- Trusted sources like Experian and Money provide reliable guidance for credit score improvement.

Understanding Credit Scores and Why They Matter

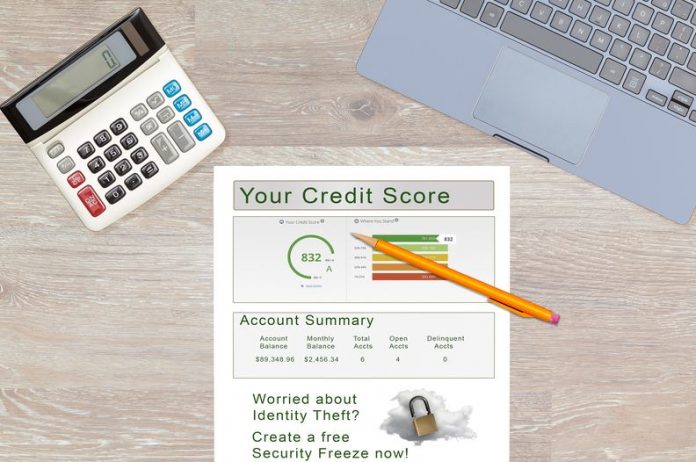

A credit score is a three-digit number that reflects your financial health. It ranges from 300 to 850, with higher scores indicating better creditworthiness. This score is calculated based on information in your credit reports, which include your payment history, credit history, and other financial behaviors.

Key Components of a Credit Score

The main factors that influence your credit score include:

- Payment History (35%): Your track record of on-time payments is the most significant factor. Late payments can lower your score, while a history of timely payments boosts it.

- Credit History (15%): The length of your credit history also plays a role. A longer history generally positively impacts your score.

- Credit Utilization (30%): This refers to how much of your available credit you’re using. Keeping this ratio low is beneficial.

- Credit Mix (10%): Having a diverse mix of credit types, such as credit cards and loans, can improve your score.

- New Credit (10%): Opening too many new credit lines in a short period can negatively affect your score.

Impact on Loan Rates and Approval

Your credit score directly influences the interest rates lenders offer and whether they approve your loan application. A higher score can lead to lower interest rates and better loan terms, saving you money over time. Lenders view a good score as an indication of lower risk, making it easier to secure loans and credit cards.

By understanding and managing these components, you can work towards a healthier credit score, making your financial goals more attainable.

Essential Steps to Build and Improve Your Credit

Building a strong credit foundation is a crucial step toward financial stability. Whether you’re starting from scratch or rebuilding your credit, taking the right approach can make a significant difference. Let’s explore some actionable strategies to help you improve your credit score and overall financial health.

Actionable Strategies for Beginners

A great starting point is to set up autopay for your bills. This ensures that payments are made on time, which is a key factor in improving your credit score. You can also set reminders to stay on top of your payments.

For those new to credit, consider using a secured credit card or a credit-builder loan. These tools are designed to help establish or rebuild your credit history. With a secured credit card, you deposit a certain amount, which becomes your credit limit, allowing you to build credit as you make purchases and payments.

Managing debt is another important aspect. Keep your credit utilization ratio low by not using too much of your available credit. Aim to use less than 30% of your credit limit to show lenders you can manage your debt responsibly.

Remember, small steps today can lead to big improvements over time. By following these strategies and maintaining good habits, you’ll be on your way to a healthier credit profile.

Save Time, Money, and Frustration and Get the Right Credit Score

A strong credit score is your pathway to financial efficiency and peace of mind. By maintaining a healthy score, you can avoid the hassle and stress that come with loan applications and debt management. This section will guide you on how to streamline your financial life and achieve long-term savings.

One of the most effective ways to save time and reduce frustration is by managing your “bill time” and payment cycles. Setting up autopay for your bills ensures that payments are made on time, which is crucial for maintaining a good credit score. Additionally, tracking your payment history helps you stay organized and avoid late fees, which can negatively impact your score.

By focusing on your credit score, you can enjoy several financial benefits. For instance, a good credit score can help you qualify for lower interest rates on loans and credit cards, saving you money over time. It also makes the loan application process smoother and faster, reducing the hassle and frustration often associated with securing credit.

To stay organized and reduce frustration, consider implementing practical strategies such as creating a budget, setting financial goals, and regularly monitoring your credit report. These steps will help you maintain a healthy credit score and achieve long-term financial efficiency.

Making On-Time Payments for a Strong Credit History

On-time payments are the cornerstone of building a strong credit history. Since payment history accounts for 35% of your credit score, consistent payments can significantly boost your financial profile. Late payments, even by a few days, can lower your score and remain on your report for up to seven years.

Setting Up Autopay and Payment Reminders

Automating your payments is a reliable way to ensure timely payments. Set up autopay through your bank or creditor’s website to deduct payments automatically. Additionally, set reminders on your calendar to stay informed about upcoming due dates. Tools like Experian Boost® can further enhance your score by linking your bank account to show positive payment behavior.

Tracking Your Payment History

Regularly monitoring your payment history helps maintain accuracy. Use free credit reports from AnnualCreditReport.com to review your history. Apps like Credit Karma or Mint can also track your payments and provide alerts. This proactive approach ensures you catch any errors early and avoid late fees.

Managing Credit Card Balances and Utilization

Effectively managing your credit card balances is essential for maintaining a healthy credit profile. High balances can negatively impact your credit utilization ratio, which is a critical factor in determining your credit score. Keeping your utilization rate low demonstrates responsible credit behavior and can significantly boost your score.

Debt Repayment Strategies

When it comes to paying down debt, there are two popular methods: the debt avalanche and the debt snowball. The debt avalanche focuses on paying off high-interest debt first, which can save you money over time. On the other hand, the debt snowball method involves tackling smaller debts first, which can provide a psychological boost as you see progress quickly. Both strategies can be effective, so choose the one that works best for you.

Balance Transfer and Consolidation Options

If you’re struggling with multiple credit card balances, consider a balance transfer or debt consolidation loan. A balance transfer allows you to move high-interest debt to a lower-interest or zero-interest card, potentially saving you money on interest. Debt consolidation loans combine all your debts into one loan with a single payment, simplifying your finances and often offering lower interest rates. However, be cautious of fees associated with these options and ensure they align with your long-term financial goals.

Monitoring your credit card balances and maintaining a low credit utilization ratio are key to improving your credit score. By implementing these strategies, you can effectively manage your debt and work towards a stronger financial future.

Keeping Old Accounts Open to Enhance Credit History

Maintaining a long credit history is crucial for a healthy credit score, as it accounts for 15% of your FICO® score. Older accounts demonstrate your ability to manage credit responsibly over time, which is viewed positively by lenders.

Closing old accounts, even if rarely used, can harm your score by shortening your credit history and lowering the average age of your accounts. This can make you appear less experienced in managing credit.

To keep old accounts active, consider using them for small, recurring purchases, like a subscription service. This minimal effort keeps the account open and contributes positively to your credit history.

A longer credit history signals to lenders that you’re experienced and reliable, enhancing your credit profile. By keeping old accounts open, you maintain a strong foundation that supports better loan terms and lower interest rates.

Diversifying Your Credit Mix for a Better Score

Your credit mix refers to the variety of credit types you have, and it plays a role in determining your credit score. A diverse mix shows lenders you can manage different types of credit responsibly.

Choosing the Right Types of Credit

A healthy credit mix typically includes a combination of installment loans and revolving credit. Installment loans, like mortgages or car loans, are paid back in fixed amounts over time. Revolving credit, such as credit cards, allows you to borrow and repay funds repeatedly up to a certain limit.

Maintaining a balance between these types of credit can improve your score. For example, using a credit card responsibly while paying off an installment loan demonstrates your ability to manage multiple credit types effectively.

When selecting credit types, consider your financial goals and current situation. A credit card is ideal for everyday purchases, while an installment loan might be better for larger, one-time expenses.

“A well-rounded credit mix can enhance your credit profile and open doors to better loan opportunities.” – Experian

By diversifying your credit mix, you signal to lenders that you’re capable of handling various financial responsibilities. This can lead to better loan terms and lower interest rates, ultimately contributing to a stronger credit score.

Limiting New Credit Applications to Protect Your Score

When it comes to maintaining a healthy credit score, it’s crucial to be mindful of new credit applications. Every application can trigger a hard inquiry, which might temporarily lower your score. Understanding how these inquiries work and exploring alternatives can help you protect your credit profile.

Understanding Hard Inquiries

A hard inquiry occurs when a lender checks your credit report to assess your eligibility for credit. This type of inquiry is recorded on your credit report and can reduce your score, especially if multiple inquiries are made in a short period. Each hard inquiry can cause a small, temporary dip in your score, and several of them can add up, signaling to lenders that you may be taking on too much debt.

It’s important to differentiate hard inquiries from soft inquiries. Soft inquiries, such as those made by you or companies for promotional purposes, don’t affect your score. Hard inquiries are typically initiated by lenders when you apply for new credit and can stay on your report for up to two years, though their impact lessens over time.

The Benefits of Prequalification

Prequalification offers a safer way to explore credit options without the risk of multiple hard inquiries. This process often involves a soft inquiry, which doesn’t impact your score, allowing you to see if you qualify for credit without penalty. Prequalification is particularly useful when shopping for major loans, as it lets you compare offers without jeopardizing your credit health.

If you’re rate-shopping for a significant loan, such as a mortgage or car loan, it’s wise to consolidate your applications within a short period. Most scoring models treat multiple inquiries for the same type of credit as a single event, minimizing their cumulative impact on your score.

Disputing Inaccurate Information on Your Credit Report

Regularly reviewing your credit report is essential to ensure accuracy. Errors can harm your score, so identifying and correcting them is crucial for maintaining good credit health.

Steps to File a Dispute

You can obtain a free credit report from AnnualCreditReport.com. Review it carefully for inaccuracies like incorrect late payments or balances. If you find errors, start the dispute process with the credit bureaus.

Gather documents supporting your claim, such as payment receipts or account statements. Submit your dispute online, by mail, or via phone, depending on the bureau’s requirements. Provide clear details about the error and attach your evidence.

Understanding the Process

Once filed, credit bureaus typically have 30 days to investigate. During this time, they may request additional information. After the investigation, they’ll notify you of their decision. If the error is corrected, an updated credit report will be provided free of charge.

“Identifying and disputing errors on your credit report can significantly improve your credit score and overall financial health.”

After 30 days, follow up to ensure corrections are made. Monitoring your credit regularly helps catch errors early and prevents future issues. Remember, accurate credit reports are vital for fair lending decisions and better loan terms.

Leveraging Authorized User Opportunities

Becoming an authorized user on someone else’s credit card can be a powerful strategy to boost your credit score, especially if you’re new to credit or rebuilding your credit. This approach allows you to benefit from the primary account holder’s positive payment history and credit habits.

An authorized user is someone who is added to an existing credit card account and can make purchases, but isn’t legally responsible for payments. When you’re added as an authorized user, the account’s payment history is typically reported to your credit report, helping you build or improve your credit score.

To make the most of this strategy, choose a primary account holder with a strong payment history and low credit utilization. This ensures the account reflects positively on your credit profile. However, remember that the primary user’s financial habits will directly impact your credit score, so it’s crucial to partner with someone who is financially responsible.

Before becoming an authorized user, discuss the arrangement with the primary account holder to ensure transparency. This strategy can be a win-win, as it helps you build credit while allowing the primary user to share account benefits. If you’re considering this approach, talk to trusted family members or mentors who can guide you through the process.

Additional Practical Tips to Boost Your Credit

Monitoring your credit and using the right tools can make a significant difference in maintaining a healthy score. Consistent effort and the right strategies will help you achieve long-term financial stability.

Monitoring Your Credit Regularly

Regularly checking your credit report is essential for catching errors or fraud early. Use free services like AnnualCreditReport.com to review your report annually. Tools like Experian Boost® can also help by linking your bank account to show positive payment history, which may improve your score.

Small improvements, such as lowering your credit utilization or making on-time payments, can lead to better loan offers. For example, reducing your credit card balance from 30% to 20% of your limit can positively impact your score.

Using Credit-Enhancing Tools and Secured Cards

Secured credit cards are a great way to build or rebuild credit. They require a deposit, which becomes your credit limit, allowing you to make purchases and payments that are reported to the credit bureaus. Using these cards responsibly can gradually improve your credit profile.

Consider enrolling in online monitoring services that track your credit utilization and debt levels. These tools often provide alerts and insights to help you stay on track and avoid negative marks on your report.

For those struggling with multiple debts, options like balance transfers or debt consolidation loans can simplify payments and potentially lower interest rates. However, be mindful of associated fees and ensure these options align with your financial goals.

By combining these strategies, you can maintain a strong credit profile and enjoy better loan terms, lower interest rates, and increased financial flexibility throughout the year.

Visit The Credit Solution Program for more resources on improving your credit health.

Conclusion

By monitoring every aspect of your credit, from payment history to credit utilization and mix, you can achieve a strong credit score that opens doors to better financial opportunities. Consistently applying strategies like on-time payments, managing balances, and disputing inaccuracies will lead to long-term improvement. A robust credit profile offers benefits like lower interest rates and better loan terms, helping you save and avoid frustration.

Small, consistent steps today can lead to significant improvements over time. Start by implementing these strategies and take the next step toward financial success. For more insights on why your credit score might be low and how to improve it, visit NerdWallet. Your efforts now will pave the way for a stronger financial future.

FAQ

How does credit utilization affect my credit score?

Credit utilization, or the percentage of your available credit being used, is a key factor. Keeping it below 30% can help improve your score.

Why is payment history important for my credit score?

Payment history is a major factor. Consistent on-time payments demonstrate responsible behavior and can significantly boost your score.

How often should I check my credit report?

Check your credit report regularly, ideally monthly, to ensure accuracy and detect any potential issues or fraud.

Can I improve my credit score by closing old accounts?

Closing old accounts might hurt your score by reducing your credit history length. It’s better to keep them open and inactive.

How do hard inquiries impact my credit score?

Hard inquiries can lower your score temporarily. Limiting new credit applications helps minimize this effect.

What are the benefits of a secured credit card?

Secured cards can help build or rebuild credit, especially for those with limited credit history, by reporting payments to credit bureaus.

How does a balance transfer affect my credit?

A balance transfer can help reduce debt but may impact your credit utilization ratio if not managed carefully.

Why is a diverse credit mix beneficial?

A mix of credit types, like loans and credit cards, shows lenders you can manage different credit responsibly.

How long does it take to see improvements in my credit score?

Improvements can be seen in a few months with consistent good habits, but significant changes may take up to a year.

Can being an authorized user help my credit?

Yes, being an authorized user on someone else’s credit card can help you build credit if the primary user has good habits.

How do I dispute an error on my credit report?

Contact the credit bureau in writing with documentation to initiate the dispute process and have inaccuracies corrected.